Do not file form 1040ez if you are claiming the premium tax credit or you are required to reconcile advance payments of the premium tax credit if you are claiming the premium.

Tax credit tables 2017 18.

Per year unless stated tax year 2016 17.

Dwp benefit rates 2017 2018.

Brown are filing a joint return.

2017 earned income credit eic table caution.

2017tax table see the instructions for line 44 in the instructions for form 1040 to see if.

Review 18 months of payment history access online payment op tions and create or modify an on.

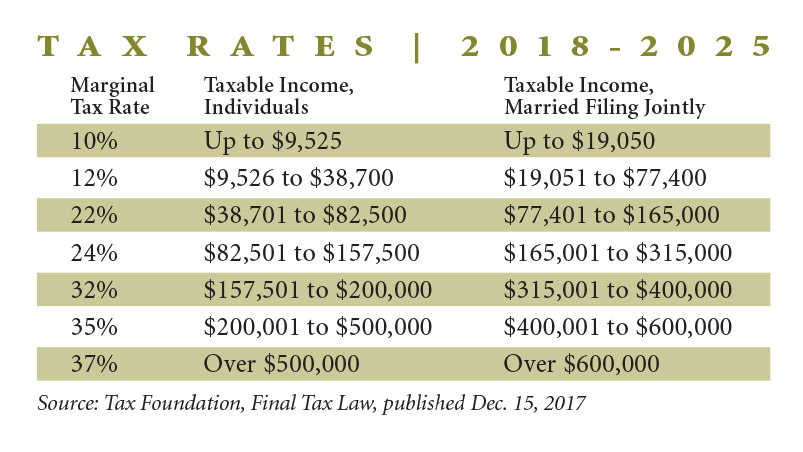

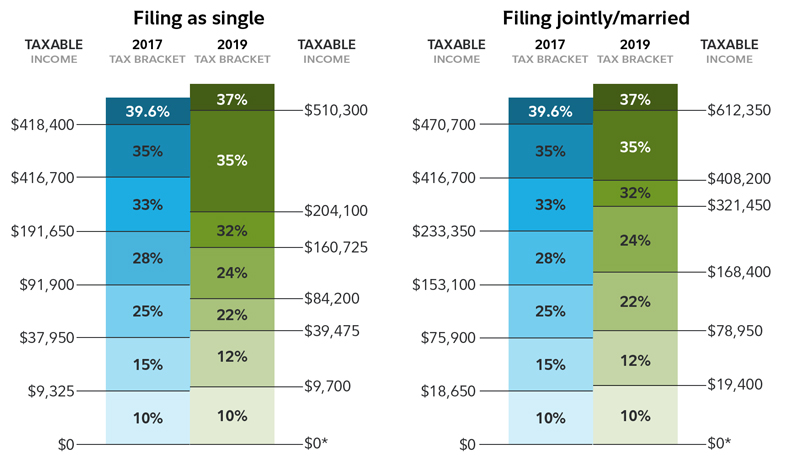

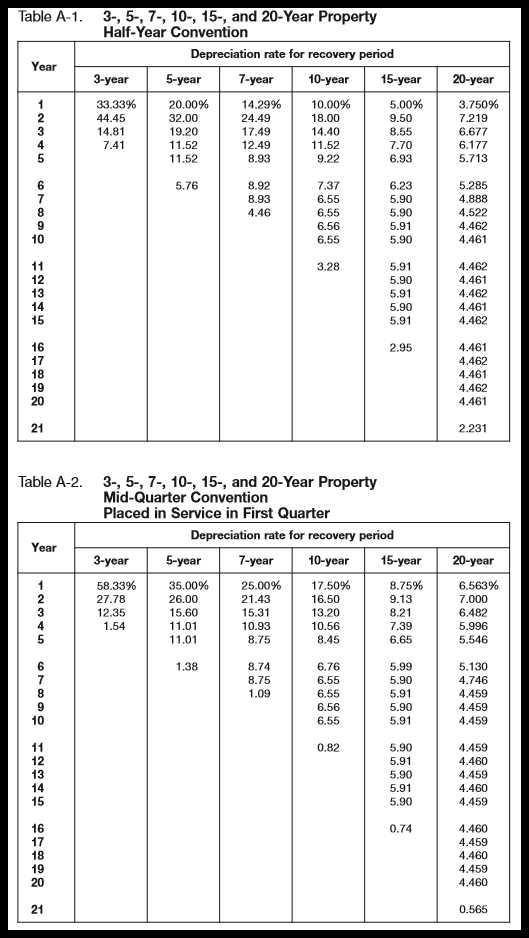

Rates and tables.

Dwp benefit rates 2016 2017.

Dwp benefit rates from april 2014.

First they find the 25 300 25 350 taxable income line.

Working tax credit basic element.

Be claimed on your 2017 tax return such as.

Tax credit annual rates.

Couple and lone parent element.

Dwp benefit rates.

Dwp benefit rates 2019 2020.

Tax credit daily rates.

Health coverage individual responsibiliyt paym ent for 2017 you must.

Their taxable income on form 1040 line 11b is 25 300.

Your return to reconcile compare the advance payments with your premium tax credit for the year.

2017 tax table 253 2017 tax computation worksheet 265 2017 tax rate schedules.

Dwp benefit rates 2015 2016.

The credit for nonbusi ness energy property b.

To find your credit read down the at least but less than columns and find the line that includes the amount you were told to look up from your eic worksheet.

For taxable years beginning on and after january 1 2017 and before january 1 2023 the college access tax credit catc is available to entities awarded the credit from the california educational facilities authority cefa.

Published 23 november 2016 explore the topic.

Dwp benefit rates 2020 2021.

The credit is 50 of the amount contributed by the taxpayer for the taxable year to the college access tax credit fund.

Dwp benefit rates 2018 2019.

The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 2 1 or a subsequent version june 22 2019 published by the web accessibility.

Then go to the column that includes your filing status and the number of qualifying children you have.

Parts of the credit for res.

Tax credits annual and daily rates.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)